Time to Ring the REIT Register?

Summary

- The recent launch of the new S&P 500 real-estate sector comes with increased visibility and scrutiny regarding investors’ real-estate holdings.

- My analysis reveals that investors who own homes may be over allocated to real-estate and may be due for a reallocation away from the sector.

- Given the REITs year-to-date performance and in light of possible selling pressure on the S&P 500 real-estate sector, investors could be justified in locking in their REIT profits.

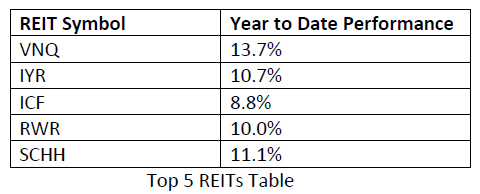

As of Friday, September 2, 2016, the top 5 Real Estate Investment Trusts (REITs), as ranked by ETFdb (see below table), are up on average 10.83% year to date—easily outpacing the broader stock market. In the same time frame, in comparison, the S&P 500 has been up 6.66%. In light of the recent launch of S&P’s new real-estate sector, investors may be wondering it is time to ring the register on the REITs?

The S&P 500 Index recently expanded from 10 sectors to 11 sectors—marking the first change in the Global Industry Classification Standard (GICS) since 1999 according to David Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. The new sector essentially comprises real-estate investment trusts, real-estate management and real-estate development companies: all carved from the previously defined and now more streamlined S&P 500 financial sector. Mortgage REITs remain in the financial sector.

The increased attention given to the new real-estate sector is expected to come with additional scrutiny. The potential financial market consequences of the GICS change are multifold. Others, including Schwab, are already increasing their coverage on real-estate, weighing in on segment fundamentals, including apartments supply, apartment rents, mall rents, et cetera.

My focus, however, is on a possible shorter term reallocation of cash away from the new real-estate sector for diversification purposes. In his June 2016 blog posting Mr. Blitzer laid the groundwork for my question by stating, “The GICS sectors are widely used to gauge how asset allocations align with markets. With real estate added to the top line of sectors, investors will notice where real estate is and whether they are over or under weighted.”

It is worth noting that investors have not always explicitly considered their home equity when making asset allocation decisions. However, this could be an oversight which is due for correction. U.S. Census Bureau data continues to affirm that home equity is by far the largest contributor to most Americans’ net worth. The launch of S&P’s real-estate sector could be a catalyst for a change in investor behavior, whereby a broader view of real-estate holdings (e.g., homes, REITs, etc.) is taken.

Background

Vanguard 2015 defined contribution (DC) plan data reveals that the average DC account balance for their participants through the end of 2015 was $96,288. The same report notes that more than 90 million Americans participate in DC retirement plans with total assets exceeding $6.7 trillion. As of 2015, Statista reports that the U.S. home ownership rate was 63.8% and the number of housing units in U.S. was 134.7 million. Statistic Brain Research Institute estimates that the average home sale price in the U.S. for 2016 is $186,000. And, according to RealtyTrac, the number of U.S. equity rich homes—defined as a homeowners having at least 50% equity in their homes—increased to 22% during Q1 2016, while the number of seriously underwater homes—defined as homeowners owing at least 25% more than the market value of their homes—decreased to 12%.

Model Assumptions

Asset allocation and diversification are well understood tools for managing risk. Together they inform investors how to divide a portfolio among different asset groups, e.g., stocks, bonds, real-estate, and among the different investment options underneath each asset group. Typically, a reallocation is performed whenever one (or more assets) grows beyond its target allocation.

While no single asset allocation strategy is appropriate for all investors and while I am not advocating any particular allocation strategy, for the sake of this analysis I assume that our model allocation attempts to have an equal dollar amount invested in each of the S&P 500 sectors. I further assume a $100,000 DC account balance (see Vanguard’s above average account balance). I assume that 60% of investors own their homes (see Statista background information above). And, I assume that each home owner on average has 30% equity in their homes representing an average home equity value of almost $56,000 (see RealtyTrac background information above).

Analysis

Now, I focus on those sixty percent of investors who own homes. Their investments include their DC accounts and their homes, which, for the above model, have a combined asset value of $160,000. Factoring in the above model’s equal weight assumption, then $14,545 would be the target allocation for each of the eleven S&P 500 sectors, including the new real-estate sector. Clearly, given the model’s estimated $56,000 home equity figure, the average investor who owns a home already has too much cash allocated to real-estate. In fact, those sixty percent of investors currently exceed the model real-estate allocation by an estimated 385%.

Target vs. Estimated Real-Estate Allocation

Source: 2-Dooz, Inc.

Conclusion

The new S&P 500 real-estate sector has made it easier than ever to determine how much an investor has allocated to real-estate. The analysis presented herein suggests that as investors reassess their own real-estate exposure, in the wake of the real-estate sector launch, they may discover that they are indeed over-allocated to real-estate. Given the year to date gains in the real-estate sector and in anticipation of the possible selling of real-estate holdings for asset reallocation purposes, no investor could be blamed for taking their REIT profits off of the table.

Disclosure: I currently hold no position in an individual real-estate REIT or any member stock of a real-estate REIT, nor do I plan to initiate any such position in the next 72 hours. I wrote this article myself. Any opinions expressed are my own. I have no business relationship with any company mentioned in this article.